Classical bubble shooter and addictively poping bubbles game.

Shoot Bubble, classical bubble shooter game and poping all bubbles in each level.

Do you know how to crush bubbles?

Find the bubbles of the same color, aim and shoot, you can eliminate all bubbles on the field.

It is simple and easy to learn and quickly get started. There is no network requirement.

You’ll be addticed to shooting bubbles anytime and anywhere, suitable for players of any age.

Are you ready to enter the paradise of Bubble Shooter?

On the basis of the classic bubble gameplay, Shoot Bubble has many innovative gameplay, rich elimination gameplay and interesting crushing rules are waiting for you to discover. It has so many surprise activities to add color to your adventure!

GAMEPLAY

* Classic bubble elimination

Launch the bubbles through the aiming line, more than 3 bubbles of the same color can trigger the smashing effect, which is simple and easy to learn.

* Innovative gameplay with powerful props

There are also many fun and powerful props. Using props reasonably can help you pass the level faster.

* Interesting activities

Pass the levels, become the champion, and get the richest rewards

GAME FEATURES

– 3000+ fun and interesting levels, continuously updated

– Distinctive element design and new gameplay

– Dynamic decompression of crushing sounds and effects

– Rich daily rewards

– Fun activities give you a different experience

– Collect special items and stay first

– Continuous elimination to obtain powerful props

– Challenge the champion to win the biggest reward

– No internet required, you can play anytime, anywhere

Shoot Bubble, a casual game suitable for all ages and can be played in any environment, come and enjoy the leisure time.

Under NPS, you can avail various online services such as contribution submission, online Transaction Statement, Tier II activation etc. in NSDL-CRA system. CRA also sends various SMS/email alerts to Subscribers including quarterly valuation of NPS investments. You can also check balance as well as manage your NPS account through NSDL NPS Mobile App ‘on the go’.

F. No. 1/3/2016-PR – In partial modification of para 1(i) of Ministry of Finance’s Gazette Notification No. 5/7/2003-ECB-PR dated 22nd December, 2003, based on the Government’s decision on 6th December, 2018 on the recommendations of a Committee set up to suggest measures for streamlining the implementation of National Pension System (NPS), the Central Government makes the following amendments in the said notification, namely :-

Latest update mate sauthi niche jao

(1) In para 1(i) of the said notification, for the words “The monthly contribution would be 10 percent of the salary and DA to be paid by the employee and matched by the Central Government”, the words “The monthly contribution would be 10 percent of the Basic Pay plus Dearness Allowance (DA) to be paid by the employee and 14 percent of the Basic Pay plus DA by the Central Government” shall be substituted.

OPS સંબંધી રાજ્ય સભાના વિડિઓ જોવા અહી ક્લિક કરો

IMPORTANT LINK:-

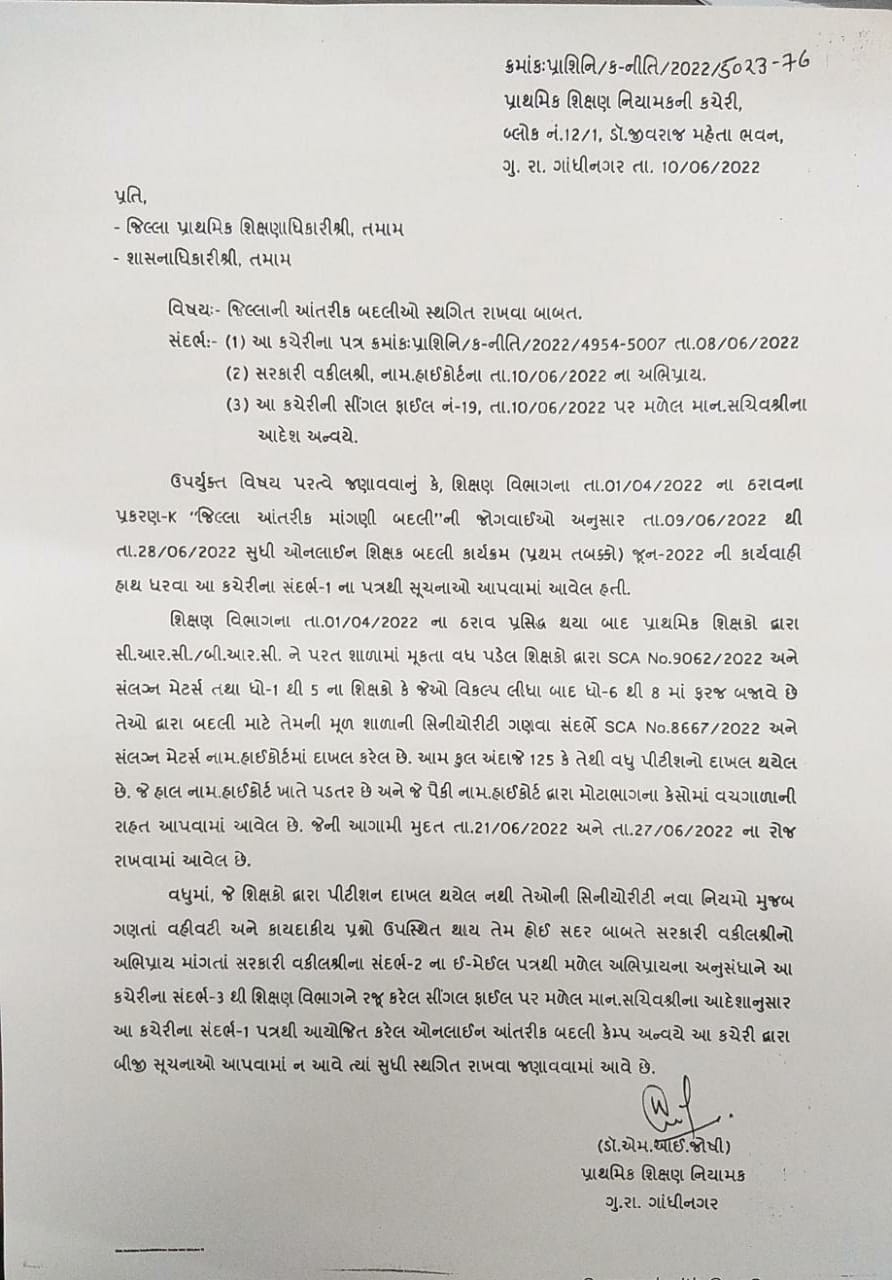

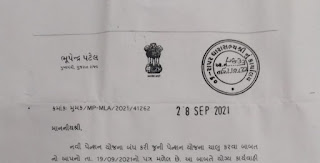

૨૦૦૪ પહેલાના કર્મચારીઓ માટે જૂની પેન્શન યોજના ચાલુ કરવા અંગે સરકારનો ઓફીસિયલ પરીપત્ર તા.૦૪/૦૧/૨૦૨૨

IMPORTANT LINK:-

જૂના પેન્શનથી છૂટેલા કર્મચારીઓને મળશે તેનો લાભ, સરકારે જારી કર્યો આદેશ માટે અહી ક્લિક કરો

(2) The following provisions shall be inserted after para 1(v) of the said notification, namely:-

CHOICE OF PENSION FUND AND INVESTMENT PATTERN IN TIER-I OF NPS AS UNDER:

(vi) Choice of Pension Fund: As in the case of subscribers in the private sector, the Government subscribers may also be allowed to choose any one of the pension funds including Private sector pension funds. They could change their option once in a year. However, the current provision of combination of the Public-Sector Pension Funds will be available as the default option for both existing as well as new Government subscribers.

NPS NIVRUTI SAMAYE GRATUITY GR DOWNLOAD KARAVA AHIN CLICK KARO

(vii) Choice of Investment pattern: The following options for investment choices may be offered to Government employees :

The existing scheme in which funds are allocated by the PFRDA among the three Public Sector Undertaking fund managers based on their past performance in accordance with the guidelines of PFRDA for Government employees may continue as default scheme for both existing and new subscribers.

CPF(NPS) MATHI PAISA UPADAVA FULL PARIPATRA DOWNLOAD KARAVA AHIN CLICK KARO

Government employees who prefer a fixed return with minimum amount of risk may be given an option to invest 100% of the funds in Government securities (Scheme G).

Government employees who prefer higher returns may be given the options of the following two Life Cycle based schemes.

09/06/22. Latest updates

જૂના પેન્શનને પુનઃસ્થાપિત કરવા પર કર્મચારીઓ સુપ્રીમ કોર્ટમાં કેસ ની વિગત અંગે અહી ક્લિક કરો