Instant Personal Loan & Credit Line app: Quick Approval | 100% Paperless

Use the moneyview loans App to get instant personal loans starting from ₹10,000 up to ₹5,00,000 in just a few minutes! Our Annual Interest rates (APR) vary from 16% to 39%* & you can choose from a wide range of flexible EMI repayment plans starting from 3 months & going up to 5 years.

For example, a loan of ₹50,000 with an annual interest rate (APR) of 24% and a repayment tenure of 12 months has a processing fee of ₹1,750 + ₹315 GST (No additional fee) & a monthly EMI of ₹4,728. The disbursed amount is ₹47,935 & the Total interest is ₹6,736. The total loan repayment amount is ₹56,736.

*These numbers are for representation only and the final interest rate or processing fee may vary from one borrower to another depending on his/her credit assessment.

moneyview is trusted by more than 1Cr users across India.

Easy-to-Apply Process

1. Download the moneyview Loans App

2. Provide basic details & check your eligibility in 2 mins!

3. Choose your loan amount & repayment tenure

4. Complete your KYC and verify your income

5. Get the money transferred directly to your Bank A/c in a few hours!

– Serving more than 5000 locations across India

– Available in 8 Languages

Eligibility

We offer personal loans for both, Salaried & Self-Employed. Min CIBIL Score of 600 or Experian of 650. The age limit for application is 21-57yrs. Income must be received in your Bank A/c.

What makes us better?

1. Own Credit Model: Get better offers regardless of your credit score

2. Easy EMIs: Repay in 3-60 Months at your convenience

3. Hassle-Free: 100% Paperless application process

4. 100% Transparent: No Hidden Charges, No Surprises!

You can also pay all your EMIs and track your entire loan repayment on our App. So, what are you waiting for? Download now!

શૈક્ષણિક આયોજન વર્ષ 2022/23 તમામ ધોરણ અને વિષયો

ધોરણ 1 થી 4 ના બાળકો માટે બેઝલાઈન સર્વેક્ષણ બાબત લેટર ડાઉનલોડ કરવા અહીં ક્લિક કરો

RBI-registered NBFC loan app in India for EMI Shopping and Instant Personal Loan

Kissht app provides Instant Line of credit and allows small shop owners to receive and make payments through QR code and avail instant loans ranging from ₹ 10,000/- to ₹ 1,00,000/- basis their credit profile. APR varies from 14% – 28% per annum and loan tenure from 3 to 24 months.

Example of Credit for Small Business Purchases

Loan amount (Principal): ₹ 30,000.

Tenure: 12 months.

Interest Rate: 18% per annum.

Processing Fee (incl. GST): ₹ 750 (2.5%).

Total Interest: ₹ 3,005.

EMI: ₹ 2,750.

APR: 22.91%.

Loan amount is ₹ 30,000. Disbursed amount is ₹ 29,250.

Total loan repayment amount is ₹ 33,000.

Total Cost of the Loan = Interest Amount + Processing Fees = ₹3005 + ₹750 = ₹3755.

Kissht is India’s quickest credit app that offers instant QR based credit to small merchants to purchase their day-to-day inventory and grow their business. Small business owners can scan & pay utility bills such as electricity bills, Gas Bills, Fast Tag, post-paid bills & can access money on credit anytime in the form of cash in their account or by scanning QR to pay any vendor.

Types of Instant Line of Credit Offered by Kissht

1. Revolving line of credit: Kissht offers a quick line of credit for salaried individuals. The loan amount ranges up to ₹30,000 with tenure from 3 to15 months, based on the individual’s credit profile and APR is between 16% and 26%. Customers can repay and reuse the credit line limit for next 2 years. To incentivize better credit behavior, the customer is offered a reduction in fees and waiver on installments upon timely repayments.

2. Instant credit to small business purchases: Facing last-minute working capital requirements, shortfall of cash to stock up inventory or regular expenses such as salaries/bill payment? opt for kissht loans from ₹10,000 to ₹1,00,000 disbursed into your account at easy and affordable interest rates ranging from 15% to 25% p.a. and processing fee in a range of 2% to 5% for the tenure up to 24 months

*Interest Rate and fees vary based on customer’s current risk profile

Examples of Instant line of credit, small business loans & Interest rates offered by Kissht

1. Revolving Line of Credit: Salaried customer can avail quick personal loan of ₹30,000 at interest rate of 18% with processing fee of ₹750 for tenure of 12 months. APR is 22.91%.

Loan amount (Principal): ₹30,000; Interest Rate: 18% per annum; Tenure: 12 months

Interest Payable: ₹3,005,

EMI: ₹2,750 per month, Total Repayment Amount: ₹33,000.

2. Instant line of credit to small business: Self-employed can avail a credit line of

₹1,00,000 for a period of 2 years. Over two-year period, the total fees (including processing fees and one-time initiation fee) charged is 9%. The interest rate is 18% per annum, APR for the revolving credit line is 27.54%.

Top categories & Small Businesses who have benefited and availed instant line of credit from Kissht

-Credit line for Kirana Shop, Medical Store

-Instant loan for Hardware stores and Electronics Shops

-Quick Cash Bakery, Snacks & Juice Shops

-Instant Cash Street vendors, Fruits & Vegetable shops

-Small business loan for Garments & tailor shop

Important link

જ્ઞાન પ્રભાવ વિદ્યાર્થીઓ ના રીપોર્ટ કાર્ડ ડાઉનલોડ કરવા માટે અહીં ક્લિક કરો

જ્ઞાન પ્રભાવ રીપોર્ટ કાર્ડ સ્ટેટ્સ જોવા માર્ગદર્શિકા ડાઉનલોડ કરવા માટે અહીં ક્લિક કરો

ધોરણ 1 વિદ્યાપ્રવેશના સાહિત્ય અંગે પ્રતિભાવો આપવા બાબત લેટર વાંચવા માટે અહીં ક્લિક કરો

ગૂગલ ફોર્મ થી પ્રતિભાવ આપવા માટે અહીં ક્લિક કરો

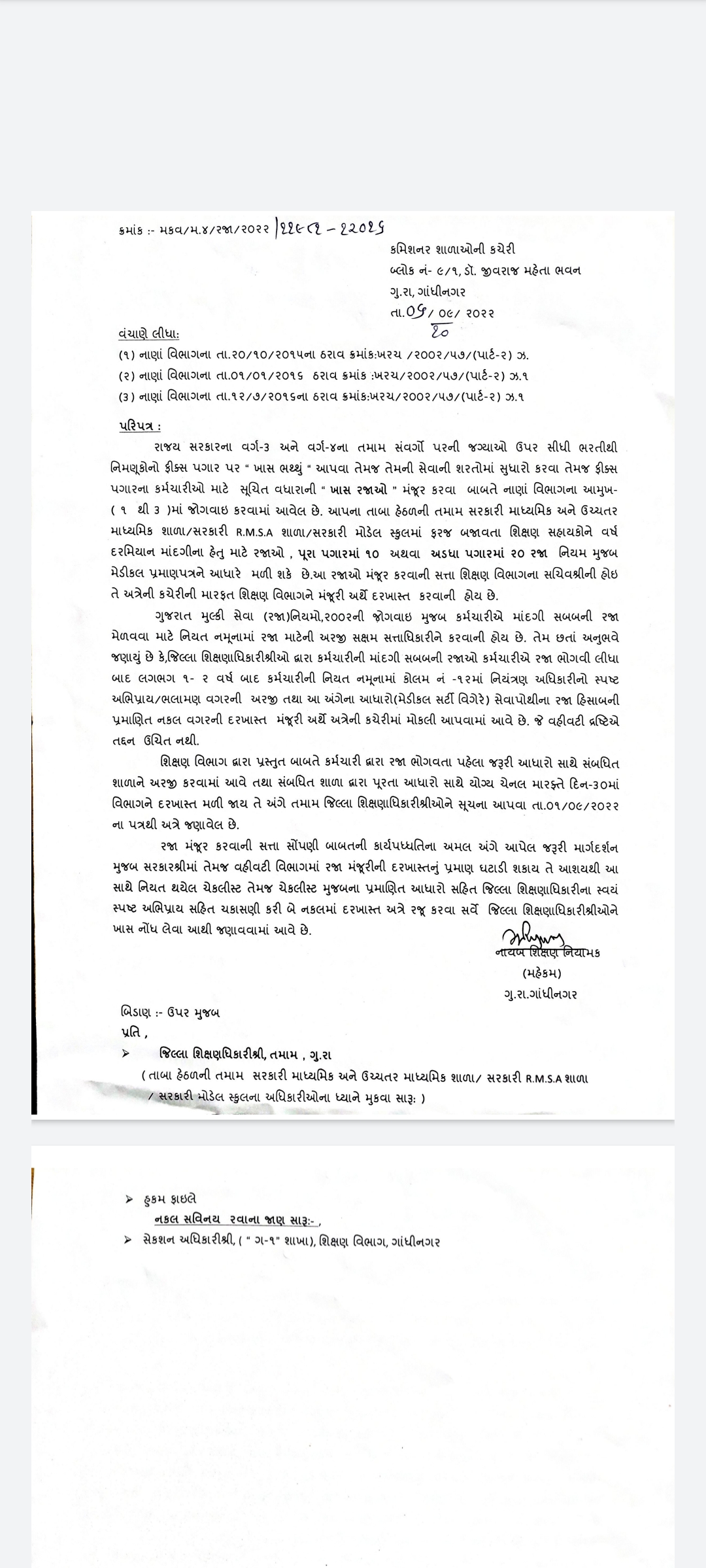

સરકારી કર્મચારીઓને 10,20,30 વર્ષે ઉચ્ચતર પગાર ધોરણ આપવા બાબત લેટેસ્ટ પરિપત્ર

How to apply for kissht credit line

1. Install Kissht app

2. Register with mobile number & accept basic permissions

3. Submit KYC documents for instant credit check

4. Sign online loan agreement from approved NBFCs. Get instant loan approval and money is transferred to your bank account

આ વખતે ગુણોત્સવ નું રીઝલ્ટ શાળાની હાજરીમાં અપડેટ કરેલ છે

ગુણોત્સવ નું રીઝલ્ટ જોવા અહીંયા ક્લિક કરો.

Why Choose Kissht for Line of Credit

✔ Low-interest rates and processing fees

✔ Online personal loan approval in just 5 minutes

✔ No collateral & credit card required

✔ 100% Secured app.

✔ We work only with RBI Registered NBFCs.The NBFCs are as follows:

-Si Creva Capital Services Pvt Ltd

-MAS Financial Services Ltd

-Fedbank Financial Services Limited